Have you ever wondered what makes successful Forex traders different from everyone else? The biggest financial market in the world is the Forex market, which is also known as the “currency market” or “foreign exchange market.” It allows traders to purchase and sell currencies from all over the world because it is open twenty-four hours a day, seven days a week.

The market is lively and volatile at different times of day, therefore not all trading hours are created equal. It’s essential to comprehend the characteristics of Forex market hours and determine the ideal times to trade FX if you want to succeed in the world of best forex brokerage.

Understanding Forex Market Hours

From Monday through Friday, the Forex market is a decentralized, worldwide market that is open 24 hours a day. The Forex market allows for continuous trading because it is an international market, in contrast to stock markets that have regular trading hours.

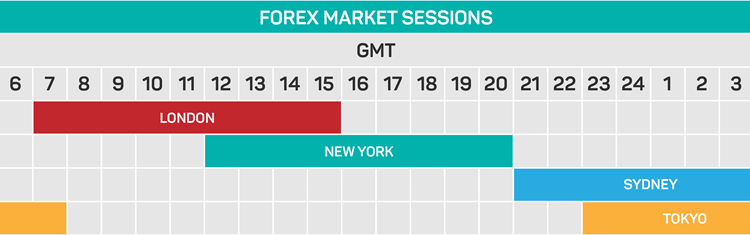

The Tokyo session, the Sydney session, the New York session, and the London session are all four primary trading sessions. The distinctive characteristics that each of these sessions has to offer must be understood by traders.

Sydney Session (Asian Session)

The week of the forex market begins with the Sydney session. It is thought to be the least active of all the trading sessions. The Australian Dollar (AUD) and the New Zealand Dollar (NZD) are the two most important currency pairings being traded during this session. Although the Sydney session frequently sets the pace for the day, it is less volatile than the periods that follow.

Tokyo Session (Asian Session)

As the Tokyo session overlaps with the Sydney session, the Forex market gets more busy when it starts. The Japanese Yen (JPY) is the most traded currency during this session, and the USD/JPY is one of the most popular currency pairs. Since there is a lot of liquidity during this overlap, price fluctuation may become more pronounced.

London Session (European Session)

The most liquid and active session, and frequently seen as the center of the forex market, is the London session. Since it follows the conclusion of the Tokyo session, there is a lot of market activity and liquidity.

The two most popular currencies in this session are the Euro (EUR) and the British Pound (GBP), with heavy trading in the EUR/USD and GBP/USD pairs. This session is frequently targeted by traders due to its high volatility and potential for profit.

New York Session (North American Session)

For a few hours, the New York session and the London session overlap, making it another incredibly busy time for forex trading. The dominant currency during this session is the US Dollar (USD), and the most actively traded currency pairs are EUR/USD, GBP/USD, and USD/JPY. The market may become more volatile as the US day goes on, particularly when significant economic developments are delivered.

Best Times to Trade FX

Before deciding on a brokerage to work with while learning the art of Forex trading and comprehending the workings of the Forex market, you should do an in-depth review of FXPrimus. Selecting a trustworthy broker can have a big impact on your trading success and general market performance.

The Overlapping Sessions

When two trading sessions overlap, that is when it is best to trade forex. Periods of increased activity, greater liquidity, and more trading opportunities characterize these overlaps.

The sessions in Tokyo and London, as well as those in New York and London, have the most noticeable overlaps. These times are favored by seasoned traders since they are recognized for having significant price changes.

London Session

Most people agree that the optimum time to trade foreign exchange is during the London session. It provides an excellent blend of liquidity and volatility, making it a desirable option for traders of all experience levels.

The EUR/USD and GBP/USD pairings, as was already noted, are extensively traded during this session, and there are frequently substantial price movements, which can be exploited for winning trades.

Economic Calendar Events

Events in the economic calendar should be closely monitored. Economic news releases like interest rate decisions, employment statistics, GDP data, and other economic indicators frequently influence forex trading.

Prices may move suddenly and significantly as a result of these disclosures. Trading around these occasions is a good idea if you want to take advantage of any possibilities, but you should also exercise caution due to the increased volatility.

The Early Hours of the Trading Day

You can find opportunities when the Asian sessions overlap with the London session if you’re an early bird or live in a time zone where you can trade during the first trading hours of the day. Profitable trades can still be made during the relatively quieter Sydney and Tokyo sessions, particularly when liquidity rises and the periods overlap.

Avoid Trading on Weekends

On the weekends, the forex market is closed. Even while some brokers might only allow a small amount of trading on the weekends, it’s usually characterized by very low liquidity and hefty spreads. To prevent unfavorable circumstances, it is preferable to avoid trading during this time.

Forex Market Hours and Your Trading Style

When figuring out the optimal times to trade FX, take into account your trading style. Scalpers may prefer the high volatility of the London and New York sessions if they plan to profit from brief price changes.

As opposed to day traders, swing traders may find it more convenient to trade during the less volatile Asian sessions because they hold positions for multiple days. To maximize your trading performance, you should match your particular schedule and trading preferences with the best Forex market hours.

Wrapping Up

It takes more than simply an awareness of currency pairs and technical analysis to master the art of Forex trading. Your chances of success can be greatly increased by being aware of the Forex market hours and figuring out when it is best to trade foreign exchange. The Forex market is active, and each of its trading sessions has its distinctive qualities. Plan your efforts around overlapping sessions, economic events, and, if possible, the busy London session to get the most out of your trading endeavors.